Contents

I understand my credit card will be charged $7 today for 7 days of Platinum access. At the end of my 7 days, my credit card will be conveniently charged $397/quarterly until I cancel. NVDA is currently trading in the 60-70% percentile range relative to its historical Stock Score levels. President Joe Biden is preparing to announce an infrastructure-rebuilding advantages and disadvantages of floating exchange rate system plan that he estimates will create up to 10 million clean energy jobs. The following areas of the economy stand to benefit from the government spending, which could total as much as $4 trillion. The first element of the plan is improving the country’s infrastructure, from roads and bridges to water systems and electricity grids.

Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. The video card shortage – As demand increased for GPUs, prices rose significantly. There was a GPU shortage recently, and Nvidia’s revenues increased substantially due to higher prices.

100 times TTM earnings and roughly 40 times TTM sales. However, now that the stock is down by nearly 70% from its highs, Nvidia broke millennial: stop scraping by and get your financial life together looks much more attractive. The chip giant is going through a challenging period and experiencing an earnings decline.

Nvidia Stock Forecast & Price Target

The stock market staged a modest rally last week, with the DJIA inching higher while the Nasdaq rallied sharply. The Dow was up less than 0.2%, the Nasdaq was up over 3%, and the S&P 500 split the difference with a 1.2% gain. Dread of Omicron has given way to “it’s just a cold” thinking, which may be as delusional as regarding Omicron as the next plague. Since January 27 , the S&P 500 has gained at least 1.45% eight times in a single day, the highest being yesterday — when the “500” exploded by 2.6%.

- Invest alongside the Financial Prophet’sAll-Weather Portfolio (2021return 51%), and achieve optimal results in any market.

- On average, 10 Wall Street analysts forecast NVDA’s earnings for 2024 to be $10,358,400,000, with the lowest NVDA earnings forecast at $7,843,500,000, and the highest NVDA earnings forecast at $12,848,400,000.

- Maybe we aren’t paying enough attention to individual names and too much attention to indices and sectors.

- On the above 2-week chart price action has enjoyed a 15000% rally since the ‘buy’ signal in July 2010.

- The quarterly cash dividend was payable on September 29, 2022 to stockholders of record on September 7, 2022.

- The chip shortage hit automakers especially hard.

Boost your investing and personal finance knowledge with bite-size educational videos. Check the Stock Market Today column to spot changes in market trend and track the best stocks to buy and… Meanwhile, new gaming chips underscore Nvidia’s continued dominance in core markets. However, challenges from rate hikes and economic uncertainty are growing.

Quotes & News

According to analysts’ consensus price target of $208.65, NVIDIA has a forecasted upside of 27.7% from its current price of $163.38. In this period, the Nvidia price would rise from $713 to $893, which is +25%. Nvidia will start 2029 at $713, then soar to $728 within the first half of the year, and finish 2029 at $743.

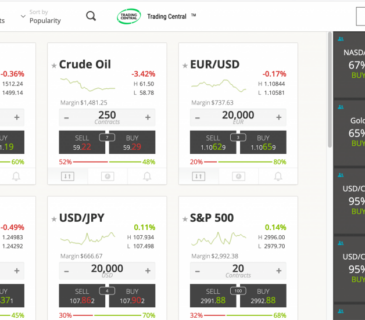

Stocks soared along with Treasuries and metals, while the U.S. dollar got slammed. Even Bitcoin and Ethereum rallied sharply after their recent gashing. The highest, average, and lowest price target of all analysts. Click on ‘Top Analysts’ to focus on the best performers.

It quickly gains acceptance gaming OEMs and more than 1 million units are shipped the first four months. Later, in 199, the company will invet the GPU and change the world of computing forever. The GPU will not only enhance the graphics capabilities of the PC but lead to accelerated-computing and AI as well. NVIDIA was founded in 1993 by three friends and is headquartered 12trader review in Santa Clara, California. The company was intended to focus on chips for the budding gaming and entertainment industry that was spawned by the rise of the personal computer and the Internet. At the time of its founding, there were less than 30 graphics-focused independent operators and that figure would more than double over the next few years.

The company issued revenue guidance of $5.78 billion-$6.02 billion, compared to the consensus revenue estimate of $6.95 billion. There are now more than 80 million Millennials, born between 1982 and 2000 and ranging in age from their early 20s to their late-30s. This generation is the largest in history – bigger than even the Baby Boomers.

Intraday data delayed at least 15 minutes or per exchange requirements. The information presented in this site is not intended to be used as the sole basis of any investment decisions, nor should it be construed as advice designed to meet the investment needs of any particular investor. Nothing in our research constitutes legal, accounting or tax advice or individually tailored investment advice. Our research is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive or obtain access to it. Our research is based on sources that we believe to be reliable. Some discussions contain forward looking statements which are based on current expectations and differences can be expected.

Taiwan Semiconductor Manufacturing

Stocks fell sharply on Thursday on continued concerns about valuation and rising Treasury yields. Investors also weighed a new round of earnings reports and weekly employment data. The Labor Department reported 730,000 first-time claims for state unemployment benefits, below the consensus forecast and the first decline in five weeks. Continuing claims of 4.419 million also fell from the prior week and came in below the consensus estimate. On the earnings front, Best Buy shares fell more than 9% following weak fiscal 4Q comp sales and disappointing sales guidance. Nvidia shares also fell 8% despite strong fourth-quarter sales and earnings.

The CPI rose 0.6% last month, up from 0.4% in February and above the Reuters consensus forecast of 0.5% growth. The Dow fell 0.3%, the S&P rose 0.1%, and the Nasdaq rose 0.7%. Crude oil traded near $60 per barrel, while gold rose $11 to $1744 per ounce. The second quarter in 2021 was a good one for stocks, as the S&P 500 increased more than 8.5%. The average stock in the Argus Universe of Coverage advanced 5.5%, and the median stock gained 4.0%.

A number of reasons now exist to be bearish. 1) A strong sell signal recently printed around the $170 area. The 1st, a trend line that has offered support since 2015 has…

The Dow fell 1.75%, the S&P 2.45%, and the Nasdaq 3.52%. Crude oil rose slightly to $63 per barrel, while gold fell $26 to $1772 per ounce. Stocks were mixed on Tuesday morning, with gains in the Technology and Consumer Discretionary sectors and losses in Financials and Industrials. Johnson & Johnson shares fell nearly 3% after the FDA and the CDC recommended a halt in the use of the company’s coronavirus vaccine on reports of a rare blood clot disorder in six U.S. recipients. Approximately 7 million people in the U.S. have already received the one-shot J&J vaccine. On the economic front, the Labor Department reported a strong increase in consumer prices in March.

The delta between GDP growth and population growth has been driven in large part by innovation. In addition, the value of listed corporations on U.S. stock exchanges at the end of 2020 was approximately $32 trillion, representing 41% of global equity market capitalization, while U.S. Stocks rallied on Thursday morning, helped by strong earnings reports from major retailers. Macy’s shares rose 16% after the company posted stronger-than-expected first-quarter sales and earnings and raised its full-year guidance. Dollar General also rose strongly following above-consensus first-quarter results. The Dow rose 1.5%, the S&P 1.8%, and the Nasdaq 2.3%.

This puts Jen-Hsun Huang in the top 10% of approval ratings compared to other CEOs of publicly-traded companies. The company is scheduled to release its next quarterly earnings announcement on Wednesday, November 16th 2022. NVIDIA has a short interest ratio (“days to cover”) of 0.5, which is generally considered an acceptable ratio of short interest to trading volume.

Dow 3033,536.70-211.16(-0.63%)

It reported a revenue of $6.7 billion, well below the previous guidance of $8.1 billion. Moreover, the EPS shrank 72% to $0.26 only, one of the worst performances in the last four quarters. Add to it, the gross margin is down from 60-65% range to 46%. So, the results missed analysts’ estimates on every parameter and hence saw the wrath of the investors. SMR Rating is a B, on a scale of A to a worst E. The EPS rating compares a company’s earnings growth to other stocks.

NVIDIA Stock Forecast Revised Higher to $201

Our analysts have been progressing through earnings season and have come across many stocks that have approached target prices. We set targets through our valuation framework, which includes analysis of historical multiples, peer multiples, and future dividends and cash flows. After adjusting for the latest information, here are some of the stocks on which we raised target prices over the past month. All of the following stocks are rated BUY at Argus. Both the potential onset of recession and the sharp move higher in interest rates have pulled the foundation out from under the equity market in 2022.

Price at the end 234, change for June 0.43%. Price at the end 233, change for May 4.95%. Price at the end 222, change for April 5.21%. Price at the end 211, change for March 4.98%. The forecast for beginning of February 212. Price at the end 201, change for February -5.19%.